Bird Global, Inc. (“Bird” or the “Company”) (NYSE:BRDS), a leader in environmentally friendly electric transportation, today announced financial results for the fourth quarter and full year ended December 31, 2021.

Travis VanderZanden, Founder and CEO of Bird, said, “We are very pleased with our strong finish to fiscal 2021. We exceeded our increased expectations for the year by capitalizing on the momentum driven by easing pandemic-related restrictions and continued adoption of micromobility by people and cities across the globe. During the fourth quarter, Rides increased over 100% year-over-year despite macro-related headwinds including the surge in Omicron cases late in the period.”

Mr. VanderZanden continued, “Throughout the first quarter we have seen a sequential increase in demand as Omicron cases have declined and weather has improved. As we look ahead, we expect demand to continue to build as more riders seek environmentally friendly transportation alternatives from gas-powered cars. We are well positioned to advance our mission while continuing to focus on our strategic initiatives including vehicle innovation, operational advancement, and global expansion in 2022 and beyond.”

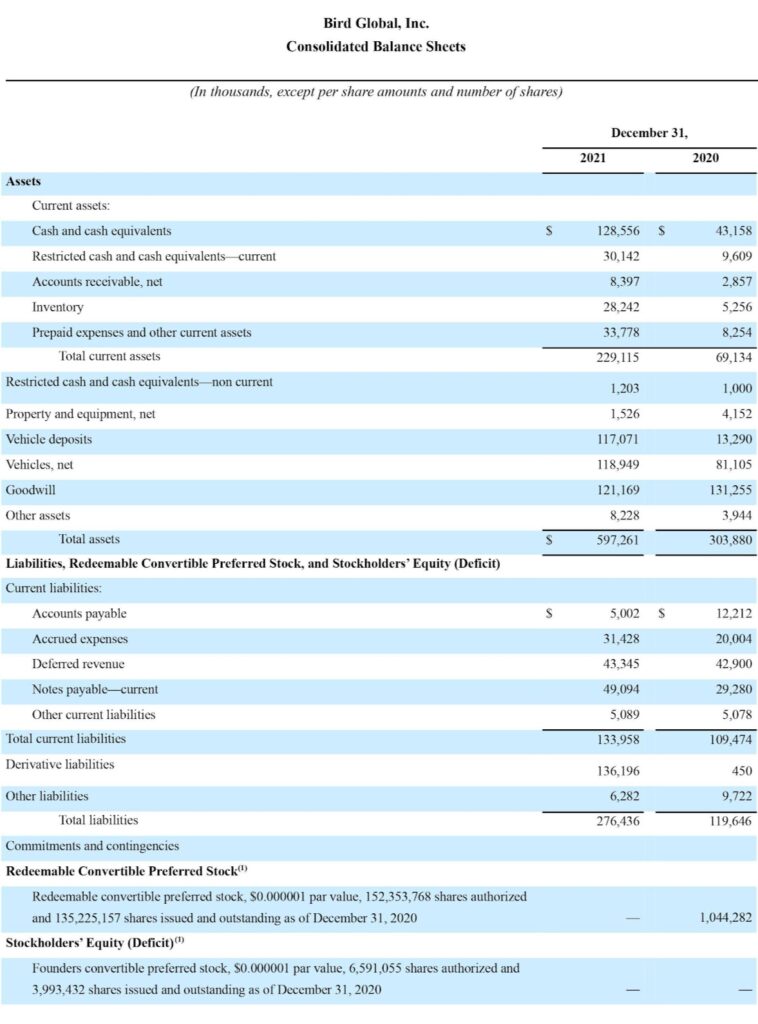

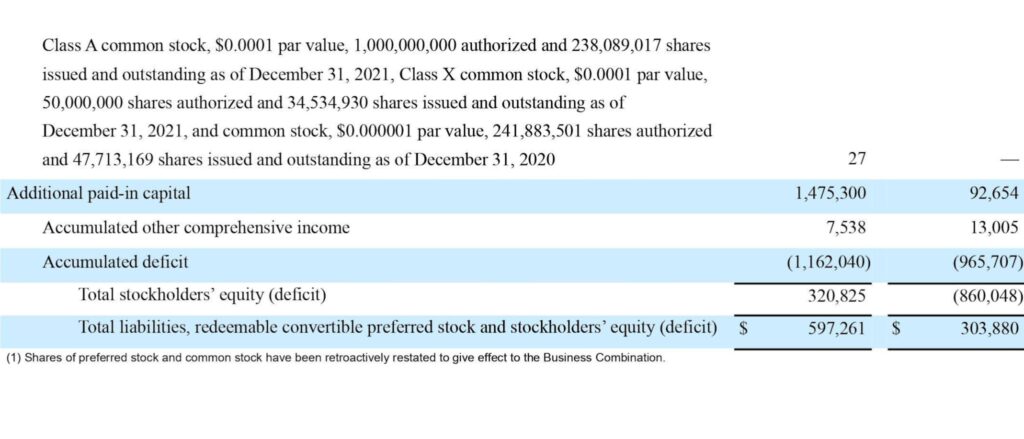

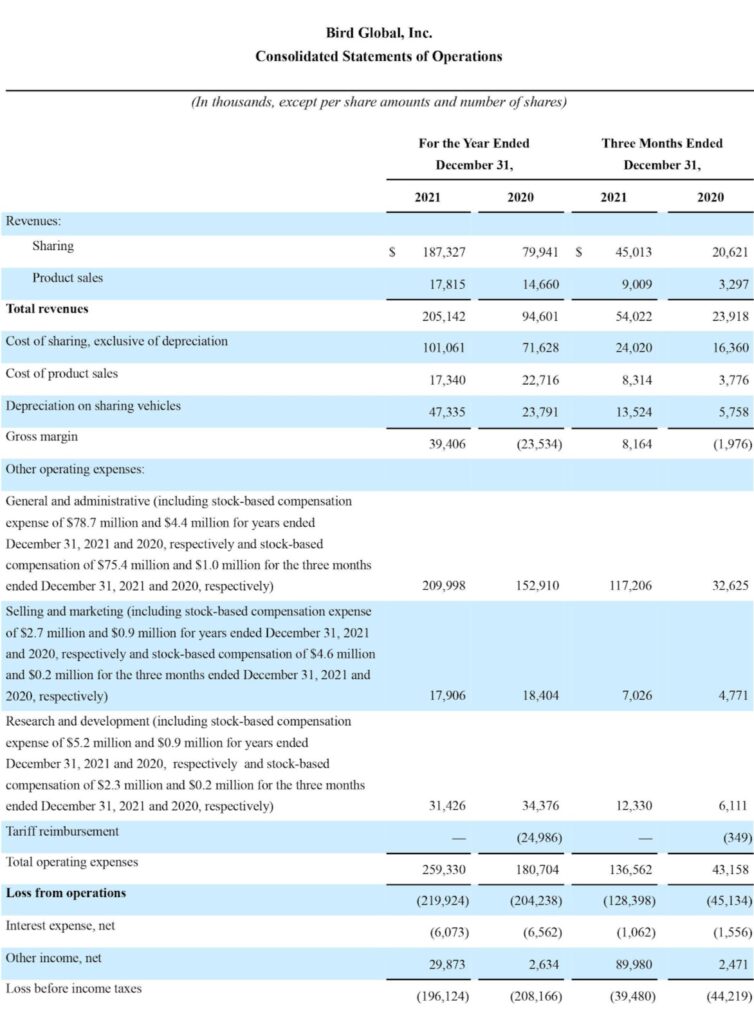

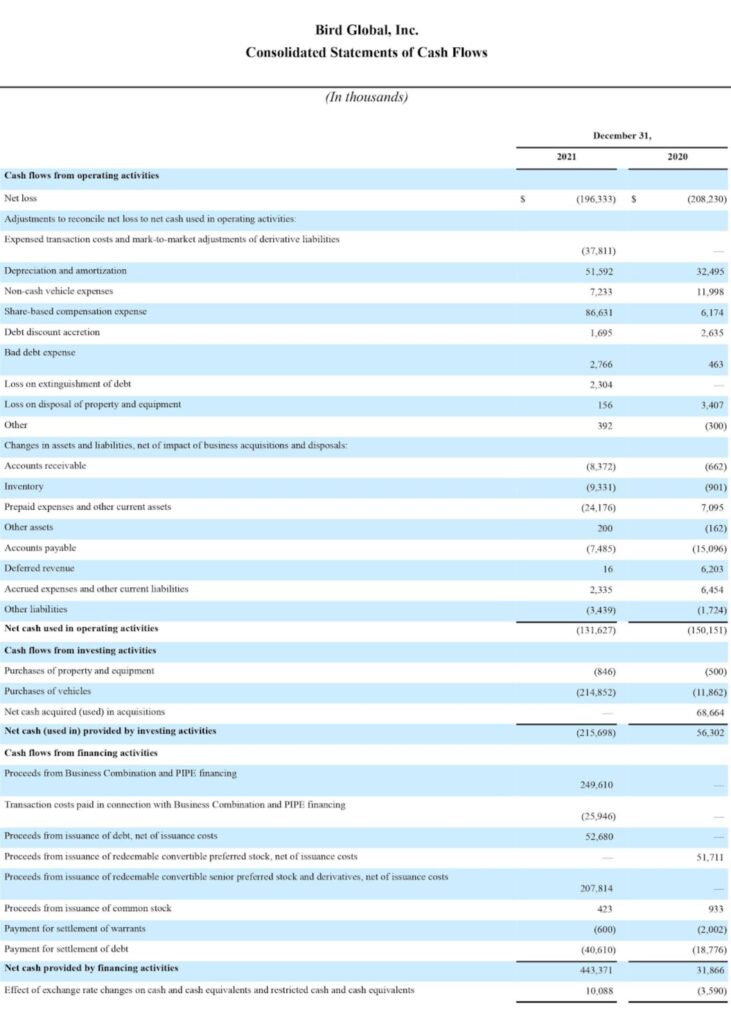

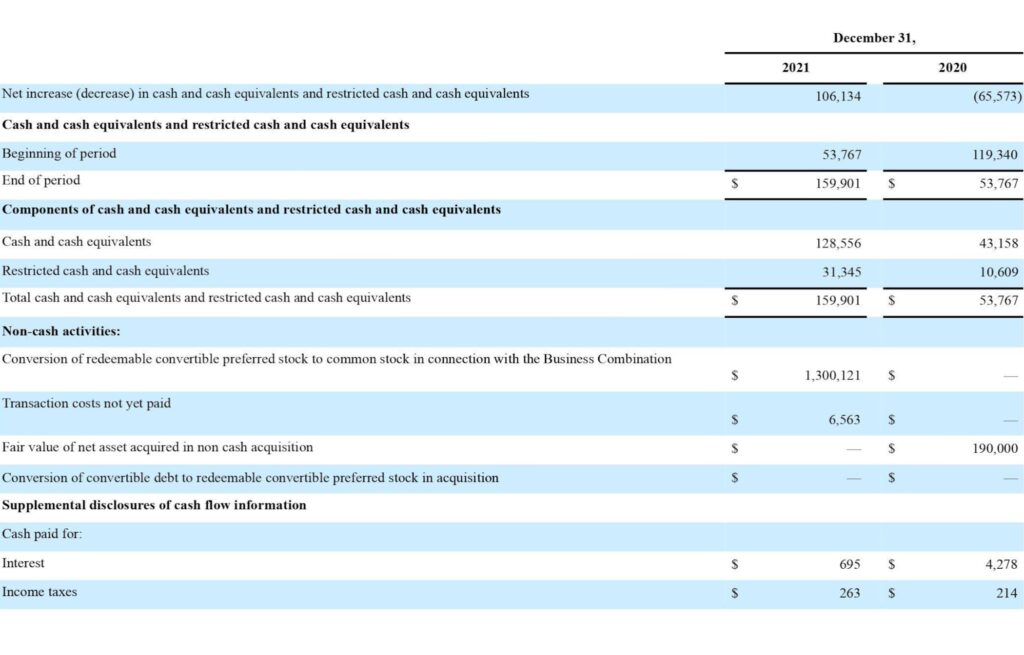

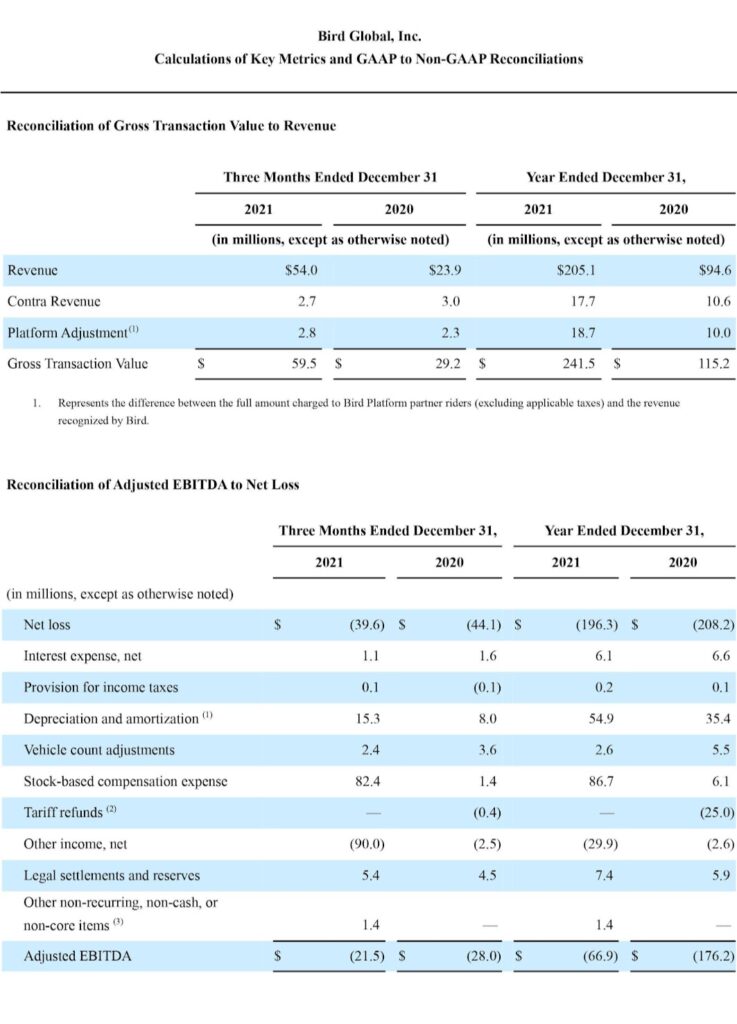

Fourth Quarter Ended December 31, 2021 Financial Results

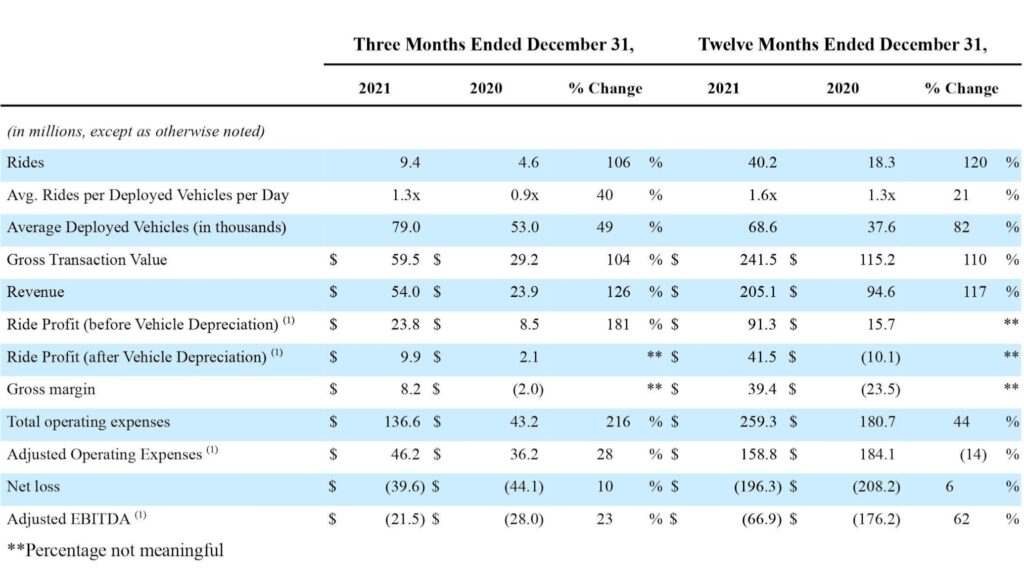

- Revenue was $54.0 million, representing an increase of 126% compared to $23.9 million in the same period in 2020 (“the prior year period”).

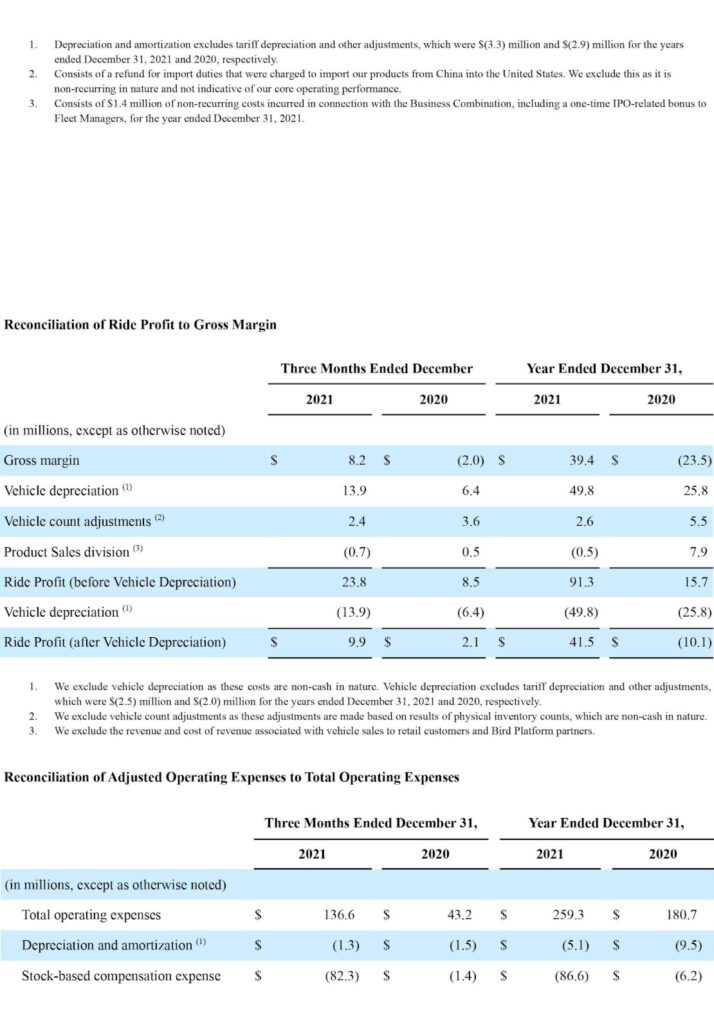

- Gross margin, which is net of vehicle depreciation, as a percentage of revenue was 15%, representing a 23 percentage point increase compared to the prior year period.

- Ride Profit (before Vehicle Depreciation) was $23.8 million, representing an increase of 181% compared to $8.5 million in the prior year period. Ride Profit (before Vehicle Depreciation) as a percentage of Sharing revenue was 53% compared to 41% for the prior year period.

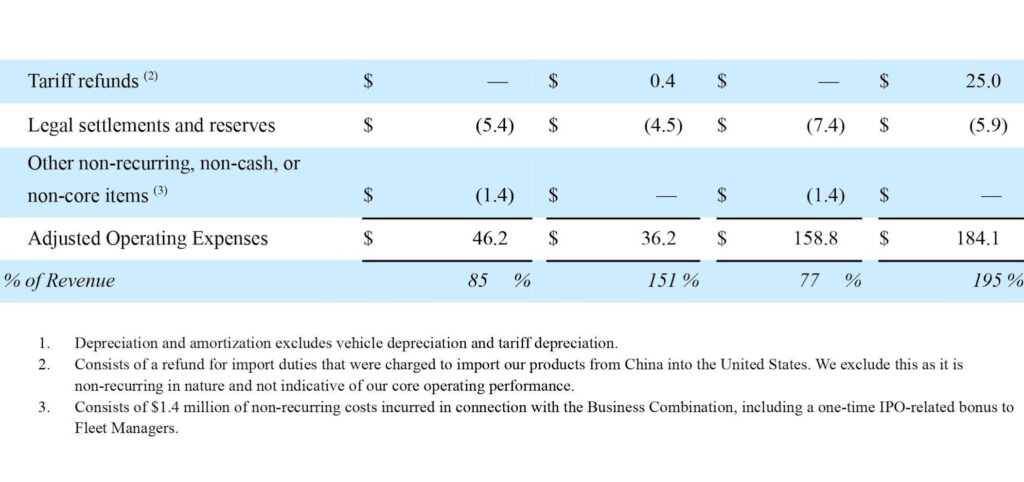

- Total operating expenses were $136.6 million, including $82.3 million of non-cash stock-based compensation expense; Adjusted Operating Expenses, which excludes the non-cash stock-based compensation expense as well as certain non-cash, non-recurring items or non-core expenses, increased 28% year-over-year.

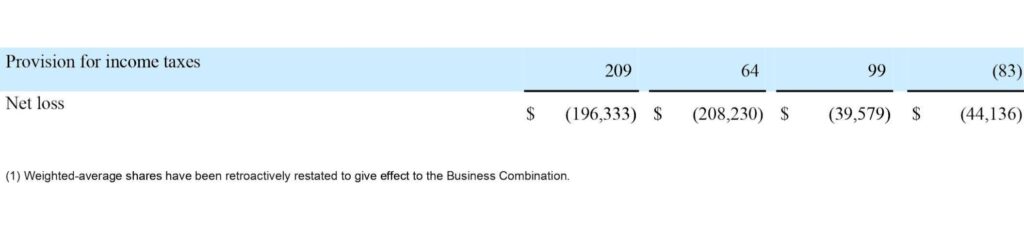

- Net loss was $(39.6) million compared to net loss of $(44.1) million in the prior year period.

- Adjusted EBITDA loss was $(21.5) million compared to $(28.0) million in the prior year period.

Full Year Ended December 31, 2021 Financial Results

- Revenue was $205.1 million, representing an increase of 117% compared to $94.6 million in 2020.

- Gross margin, which is net of vehicle depreciation, as a percentage of revenue was 19%, representing a 44 percentage point increase compared to the prior year.

- Ride Profit (before Vehicle Depreciation) was $91.3 million compared to $15.7 million in 2020. Ride Profit (before Vehicle Depreciation) as a percentage of Sharing revenue was 49% compared to 20% for the prior year.

- Total operating expenses were $259.3 million, including $86.6 million of non-cash stock-based compensation expense; Adjusted Operating Expenses, which excludes the non-cash stock-based compensation expense as well as certain non-cash, non-recurring items or non-core expenses, decreased 14% year-over-year.

- Net loss was $(196.3) million compared to net loss of $(208.2) million in the prior year.

- Adjusted EBITDA loss was $(66.9) million compared to $(176.2) million in the prior year.

“Our fiscal 2021 results demonstrate the strength of our model and our continued focus on profitability as we delivered Adjusted EBITDA above our expectations, driven in part by significant margin improvement. Our Ride Profit Margin (before Vehicle Depreciation) increased to 49% in 2021 from 20% in 2020. We also reported our first full year of positive gross margin, which was also positive in each quarter, translating to a 44 percentage point increase as a percentage of revenue year-over-year,” said Yibo Ling, Chief Financial Officer of Bird. “We expect to see continued margin improvement despite ongoing macro headwinds as the effectiveness of our Fleet Manager operating model and durability of our Bird-designed vehicles continue to prove successful. We remained well capitalized heading into the year and are pleased with the momentum that has been building since the start of the year, with the March to-date Gross Transaction Value trend implying over 50% growth month-over-month. These trends, along with the impact of peak Omicron cases from January, are embedded in our guidance.”

Q1 & FY 2022 Outlook

The Company has provided the below outlook for 2022:

- First quarter revenue is expected to be between $34 million and $36 million.

- Full year revenue is expected to be at least $350 million.

The above outlook assumes no material deterioration in the Company’s current business operations and supply chain as a result of geopolitical instability as well as COVID-19, its variants, or any other unforeseen macro developments, aside from the known impact of COVID-19 in Q1.

(1) Ride Profit, Adjusted Operating Expenses and Adjusted EBITDA are non-GAAP financial measures. See “Non-GAAP Financial Measures and Key Metrics” for additional information on non-GAAP financial measures and the appendix to this press release for a reconciliation to the most comparable GAAP measures.

Business Highlights

In addition to delivering strong financial results, Bird continued its track record of operational success over the course of 2021 across a number of categories, most notably:

- Vehicle Innovation: Bird continues to be a leader in micromobility technology, and in 2021 released new technology for the Company’s Sharing and Product Sales businesses:

- Unveiling of Bird’s consumer e-bike, the Bird Bike, targeted at capturing demand for privately owned e-bikes

- Roll-out of the Bird Three, Bird’s third generation e-scooter, which represented 37% of Bird’s fleet at year-end and alongside other Bird-designed Sharing business vehicles continues to extend its operating life

- Debut of cutting edge smart sidewalk detection technology to prevent sidewalk and footpath riding

- Global Reach: Bird’s fast path of expansion continued in 2021 with new notable launches across the Sharing business:

- Introduction of Bird’s e-bike sharing service, which expanded the Company’s serviceable addressable market by five billion trips annually

- Launch of Bird’s shared e-scooters in New York City, for which we expect our fleet size to double in size this spring; program extensions in Washington DC and Marseille, France

Presentation

This press release presents historical results, for certain periods presented, of Blue Jay Transit, Inc., the predecessor of Bird Global, Inc. for financial reporting purposes. The financial results of Bird Global, Inc. prior to the fourth quarter of 2021, outside of figures included for year-over-year comparison, have not been included in this press release as it is a recently incorporated entity and had not engaged in any business or other activities during the periods prior to the fourth quarter of 2021. Accordingly, these historical results do not purport to reflect what the results of operations of Bird Global, Inc. would have been had the business combination with Switchback II Corporation (the “Business Combination”) occurred prior to such periods. All financial comparisons in this press release compare our financial results from the fourth quarter of 2021 to our financial results from the fourth quarter of 2020, or from the year ended December 31, 2021 to the year ended December 31, 2020.

Conference Call Information

A conference call to discuss the Company’s fourth quarter and full year 2021 financial results and other business updates is scheduled for today, March 15, 2022, at 4:30 pm Eastern time. Those interested in participating in the call are invited to dial (877) 407-0792 or (201) 689-8263 if calling internationally. A live audio webcast of the conference call will be available on our investor relations website (https://ir.bird.co).

A recording of the conference call will be available approximately two hours following the call and can be accessed online for 90 days.

About Bird

Bird is an electric vehicle company dedicated to bringing affordable, environmentally friendly transportation solutions such as e-scooters and e-bikes to communities across the world. Founded in 2017 by transportation pioneer Travis VanderZanden, Bird is rapidly expanding. Today, it provides fleets of shared micro electric vehicles to riders in more than 400 cities globally and makes its products available for purchase at www.bird.co and via leading retailers and distribution partners. Bird partners closely with the cities in which it operates to provide a reliable and affordable transportation option for people who live and work there.

Non-GAAP Financial Measures and Key Metrics

This press release contains “Ride Profit,” “Ride Profit Margin,” “Adjusted Operating Expenses,” and “Adjusted EBITDA,” which are measures that are not prepared and presented in accordance with generally accepted accounting principles in the United States (“GAAP”). The presentation of this financial information is not intended to be considered in isolation or as a substitute for, or superior to, the financial information prepared and presented in accordance with GAAP. Ride Profit reflects the profit generated from rides in our Sharing business after accounting for direct ride expenses, which primarily consist of payments to Fleet Managers. Other ride costs include payment processing fees, network infrastructure, and city permit fees. We calculate Ride Profit (i) before vehicle depreciation to illustrate the cash return and (ii) after vehicle depreciation to illustrate the impact of the evolution of our vehicles. Ride Profit Margin is Ride Profit divided by the revenue we generate from our Sharing business. We use Ride Profit Margin for financial and operational decision-making and as a means to evaluate period-to-period comparisons. We believe that Ride Profit and Ride Profit Margin are useful indicators of the economics of our Sharing business, as they exclude indirect unallocated expenses such as research and development, selling and marketing, and general and administrative expenses. Adjusted Operating Expenses is a supplemental measure of operating expenses used to provide investors with additional information about the Company’s business performance. We believe Adjusted Operating Expenses is useful in evaluating the operational costs of our business as it excludes impact from items that are non-cash in nature, non-recurring, or not related to our core business operations. We calculate Adjusted Operating Expenses as total operating expenses, adjusted to exclude (i) depreciation and amortization associated with operating expenses, (ii) stock-based compensation expense, (iii) tariff refunds, (iv) legal settlements and reserves, and (v) other non-recurring, non-cash, or non-core items. Adjusted EBITDA is a supplemental measure of operating performance used to inform management decisions for the business. We believe Adjusted EBITDA is useful in evaluating our performance on a relative basis to other comparable businesses as it excludes impact from items that are non-cash in nature, non-recurring, or not related to our core business operations. We calculate Adjusted EBITDA as net profit or loss, adjusted to exclude (i) interest expense (income), net, (ii) provision for (benefit from) income taxes, (iii) depreciation and amortization, (iv) vehicle count adjustments, (v) stock-based compensation expense, (vi) tariff refunds, (vii) other income (expense), net, (viii) legal settlements and reserves, and (ix) other non-recurring, non-cash, or non-core items. There are a number of limitations related to the use of non-GAAP financial measures. In light of these limitations, we provide specific information regarding the GAAP amounts excluded from Ride Profit, Ride Profit Margin, Adjusted Operating Expenses and Adjusted EBITDA. For reconciliations of these non-GAAP financial measures to the most directly comparable GAAP financial measures, see the appendix to this press release.

This press release also contains certain key business metrics which are used to evaluate our business, measure our performance, identify trends affecting our business, formulate business plans, and make strategic decisions. Gross Transaction Value (“GTV”) reflects the total dollar value, excluding any applicable taxes, of Rides in our Sharing business and vehicle sales to retail customers and Bird Platform partners, in each case without any adjustment for retail discounts or refunds. In order to calculate GTV, we add back contra revenues from both Sharing and Product Sales and adjustments to the Bird platform revenue we recognize. GTV is a key indicator of the scale of our business and ultimately drives revenue. We calculate Rides as the total number of trips completed by customers of our Sharing business. Rides are seasonal to a certain degree. Deployed Vehicles reflects the number of vehicles available to riders through our Sharing business. We calculate Deployed Vehicles on a pro-rata basis over a 24-hour period, wherein two vehicles deployed for a combined period of 24 hours equate to one Deployed Vehicle. Rides per Deployed Vehicle per Day (“RpD”) reflects the rate at which our shared vehicles are utilized by riders. We calculate RpD as the total number of Rides divided by total Deployed Vehicles in our Sharing business each calendar day.

Forward-Looking Statements

This press release includes forward-looking statements within the meaning of the Private Securities Litigation Reform Act of 1995, as amended. We based these forward-looking statements on our current expectations and projections about future events. All statements, other than statements of present or historical fact included in this press release, regarding our future financial performance and our strategy, expansion plans, future operations, future operating results, revenue for the first quarter and full year 2022, losses, projected costs, prospects, plans, and objectives of our management are forward-looking statements. In some cases, you can identify forward-looking statements by terminology such as “may,” “should,” “could,” “would,” “expect,” “plan,” “anticipate,” “intend,” “believe,” “estimate,” “continue,” “project,” or the negative of such terms or other similar expressions. These forward-looking statements are subject to known and unknown risks, uncertainties and assumptions that may cause actual results, levels of activity, performance, or achievements to be materially different from any future results, levels of activity, performance, or achievements expressed or implied by such forward-looking statements. Except as otherwise required by applicable law, we disclaim any duty to update any forward-looking statements, all of which are expressly qualified by the statements in this section, to reflect events or circumstances after the date of this press release. We caution you that these forward-looking statements are subject to numerous risks and uncertainties, most of which are difficult to predict and many of which are beyond our control. Many factors could cause actual future events to differ materially from the forward-looking statements in this press release, including, but not limited to: the COVID-19 pandemic and the impact of the actions taken to mitigate the pandemic; the Company’s relatively short operating history and new and evolving business model; the fact that the Company has incurred significant operating losses in the past and may not be able to achieve or maintain profitability in the future; the Company’s ability to retain existing riders or add new riders, or maintain or increase riders’ level of engagement with the Company’s products and services; the Company’s ability to attract and continue to work with qualified Fleet Managers, or manage Fleet Managers’ utilization rates; changes to the Company’s pricing and its effect on the Company’s ability to attract or retain the services of qualified Fleet Managers and riders; the ability of Fleet Managers to maintain vehicle quality or service levels, or material changes to labor classifications or franchise regulations; competition in the Company’s new and rapidly changing industry; the impact of poor weather and seasonality on the use of the Company’s products and services; the Company’s ability to obtain vehicles that meet quality specifications in sufficient quantities on commercially reasonable terms, which has been affected by global supply chain constraints; the Company’s reliance on third-party insurance policies; illegal, improper or inappropriate activity of riders; exposure to product liability in the event of significant vehicle damage or reliability issues; the Company’s metrics and estimates, including the Company’s key metrics, being subject to inherent challenges in measurement; the Company’s general reliance on third party distributors, partners, and payment processors for various parts of our business and the Company’s ability to manage these relationships; defects in our vehicles, mobile applications, or other services; action by governmental authorities to restrict access to Bird’s products and services in their localities; the Company’s presence and expansion in international markets and associated risks, including the ongoing conflict between Ukraine and Russia; the Company’s substantial indebtedness level; the Company’s access to additional capital; the Company’s user growth and engagement on mobile devices depending upon effective operation with mobile operating systems, networks, and standards outside the Company’s control; intellectual property rights claims and other litigation; data security breaches or other network or system outages or delays; compliance with and changes in applicable laws or regulations; and other risks, uncertainties and factors discussed in the “Risk Factors” section of the Company’s Annual Report on Form 10-K filed with the Securities and Exchange Commission (“SEC”) on March 15, 2022 and in the Company’s subsequent filings with the SEC. The forward-looking statements in this press release speak only as of the time made and the Company does not undertake to update or revise them to reflect future events or circumstances.